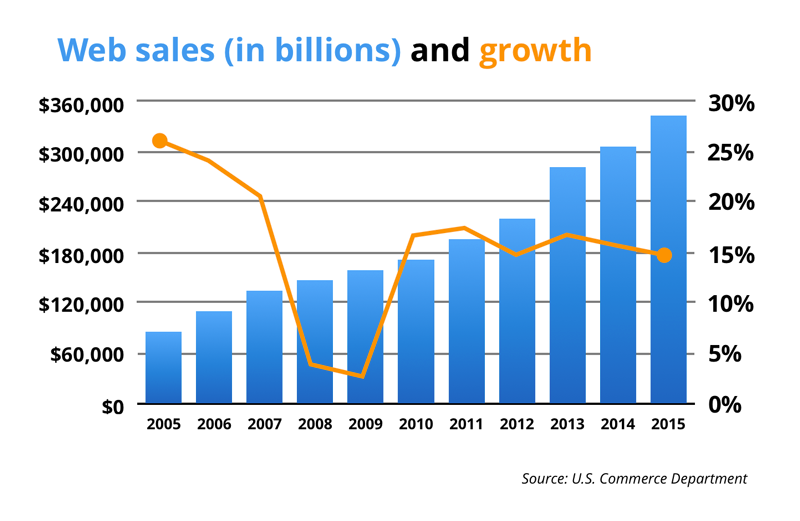

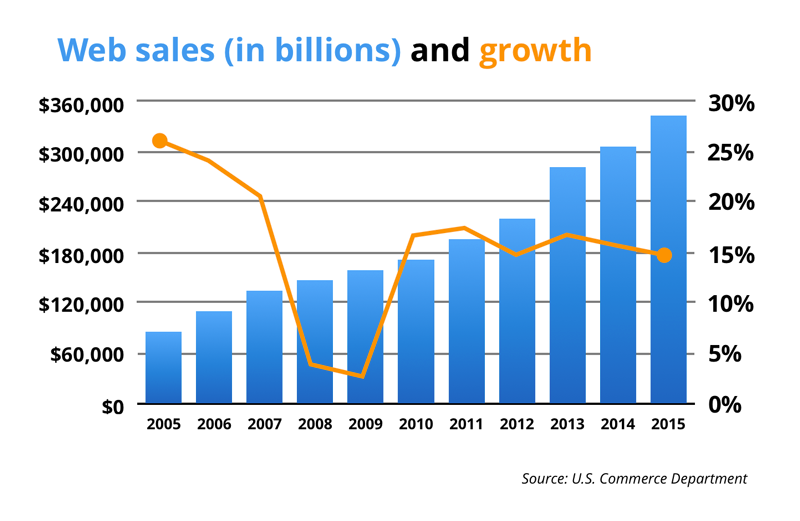

No one knows "how high is up" in the world of online commerce. The fact that U.S. e-commerce sales grew 14.6% in 2015 is not a surprise-nor is the fact that 2016 is tracking to 15% to 16% growth. What is more compelling is that online has been growing at this rate since 2010. There may be no other industry metric in history to expand at such a consistent rate over this length of time.

Another way to think of it: When you take out categories like fuel and automobiles, online sales growth in 2015 accounted for all retail growth. In other words, there was no retail sales growth on average in the brick-and-mortar categories of fashion, furniture, food, etc. At this compound growth rate, e-commerce will be half of these retail sales within a decade.

What's most surprising is that most Private Equity deals I'm involved in haven't made mastery of online distribution a key "How" for their business future. This is despite the fact that e-commerce deliveries are now half of UPS' entire business. Even some of our Early Stage companies are behaving as if selling through Target, Ferguson Plumbing or local car dealerships is the way it will always be. And our higher education connections? By and large, college faculties continue to see themselves standing in front of a live audience-forever. That is just not going to happen.

The Key Learning: Any institution that wants to be around in a decade or two has to come to terms with the idea that their primary distribution channel will be online; delivered direct to the buyer. As traditional distribution models—retailers, distributors, franchised dealers or professors in classrooms—garner less and less of the total business, their average costs per “buyer” will go up and up. In turn, this will accelerate their own inability to compete. The time to change gears may be now, before the “vulturous circle” takes over.

Last updated on October 14, 2016