It’s no secret that Thanksgiving week online sales events such as Black Friday and Cyber Monday hit all-time highs in the United States this year:

- Thanksgiving Day online sales grew 25% year-over-year, raking in $1.73 billion. Average order value rose nearly 10%

- Black Friday online sales generated $2.74 billion, a year-over-year increase of 14.3%

- Cyber Monday’s online-exclusive sales were supercharged: $3.07 billion, a 16% increase over 2014

However, some folks might not know that these late-November, “uniquely American” sales events are spreading overseas, seeing the widest adoption in European markets such as the UK, France and Germany.

The UK press often credits Amazon as the “patient zero” of Black Friday—the e-commerce giant presented online Black Friday deals to Britons back in 2010, and local retailers swiftly followed suit. In some cases, the result has been frenzied customer behavior, just like in the States. Last year, the reputation of Walmart-owned UK retailer Asda got a Black Friday black eye when fistfights erupted between sale-hungry shoppers.

According to a Barclays report, over 75% of UK retailers planned to hold Black Friday sales this year. Another report projected this year's sales would increase 20% over 2014's. That figure that was blown away by one post-Black Friday statistic-36%, according to Experian-IMRG.

The phenom is spreading. More recently, France and Germany retailers have embraced the sales. And like in the UK, these companies have seen most of their Black Friday revenue generated through online and mobile sales.

MotionPoint wanted to look past the headlines and hype, and understand how robustly European shoppers were embracing these online sales. We recently examined sales data from several major apparel retailers that serve European markets online, in multiple languages. Our findings?

"Firstly, across the board, Black Friday appears to be the bigger hit than Cyber Monday," explains Eric Watson, a Global Online Strategist for MotionPoint's Global Growth team. "We believe this is mostly because the term 'Cyber Monday' simply doesn't yet have the same name recognition. European retailers that are looking to cash in next year should definitely build their campaigns around 'Black Friday' messaging."

The UK

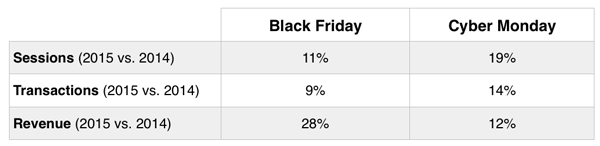

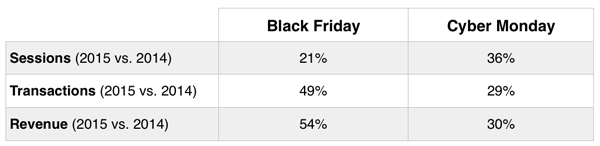

Based on our analysis of the localised UK, French and German e-commerce sites we operate, UK sites saw the lowest overall year-over-year growth during Black Friday and Cyber Monday:

We believe this comparatively-reduced growth is due to the faster adoption of American shopping holidays by UK retailers. "American English-to-British English localisation means more opportunities for easier messaging," Eric says, "and more sharing of emerging cultural traditions like Black Friday."

Black Friday growth is certainly slowing in brick-and-mortar UK stores, as illustrated by news reports of shorter lines in shops. There may be a bit of Black Friday Burnout at play here, too. According to a recent Ipsos consumer study, European awareness for Black Friday is the highest in the UK. (81% of UK shoppers said they were aware of Black Friday.) But consumer disdain is highest here, too. Of nearly 1,900 surveyed Britons, 36% said they "disliked" the sales day. We suspect this backlash is largely informed by the negative press Black Friday received last year, with widely reported incidents of in-store violence.

“As the UK continues to mature as a Black Friday-friendly market,” Eric advises, “savvy companies should look to France and Germany as emerging hot markets for the sales event.”

France and Germany

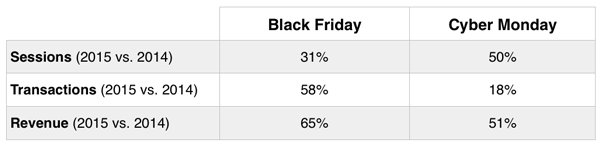

With the French sites we operate, we were able to examine the sales performance of localised sites that hosted Black Friday and Cyber Monday sales. We also were able to compare that performance against one localised site that didn't host Black Friday sales. (The French site that didn't host a sale had an American "parent" retail site that did.) Let's look at the results:

These companies offered Black Friday and Cyber Monday specials in French. Note the robust growth in the quantity of sessions, transactions and revenue:

In contrast, the company that did not offer Black Friday and Cyber Monday specials in French saw far less success:

"French customers clearly came ready to shop on this site, but they didn't convert," Eric says. "That's a major lost opportunity. French shoppers are renowned for being bargain hunters. As more retailers adopt Black Friday sales during this season, those who don't will see increasingly poor performance on these days."

French customers, along with the rest of the world, are increasingly aware of American shopping holidays and clearly respond to savvy companies that acknowledge this. We believe Black Friday represents a lucrative First Mover opportunity for companies.

"Retailers should move fast on this," Eric says. "As the value of Black Friday becomes more widely known among retailers in the French market, competition will increase dramatically."

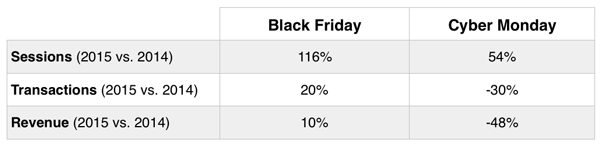

Let’s take a quick look at German Black Friday online activity:

Black Friday sales results in Germany reveal year-over-year growth, though at a more muted rate. Germans are generally more prudent with online spending, more concerned about online security, and less swayed by sales.

Last updated on December 04, 2015